Visa Europe: Biometrics may enable mobile payments

14 July, 2014

category: Biometrics, Financial

In order to enable quicker and more secure payments on mobile devices, retailers are turning to different APIs that store payment card data in the cloud. This way a consumer doesn’t have to type in all the payment card information but instead just properly authenticate to the site, says Jonathan Vaux, director of New Payment Propositions at Visa Europe.

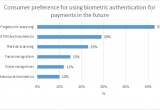

On way that consumers may be identified is with biometrics. Samsung and PayPal announced earlier this year that the fingerprint scanner on the S5 would enable payments. Apple also announced that it was opening up the API for Touch ID fingerprint sensor to app developers so that it could be used for authentication.

“These announcements serve as a great example of the speed of change in our industry and our need to adapt quickly,” Vaux said in his blog post. “Visa’s digital payments objective is to be top of any app, any wallet and any device, and this technology can be a fantastic enabler for us to achieve that goal. What we have to do is strive to ensure the payment experience facilitated by such technology is safe, secure and consistent for consumers.

“We are witnessing the evolution of a new digital payment age. We need to develop new standards, processes and capabilities that help enable these technologies which will, potentially, help us achieve our ambitions to be the world’s most trusted currency and displace cash and checks. For example, we will need to recognize other forms of authentication, such as thumbprint, in our process flows and evaluate its impact on the commercial framework. As well as driving card preference in digital payments, this will also create opportunities for our processing business and for us to extend our role as a trusted broker and facilitator in the payments to include new players such as Operating Systems.”