Smart cards could curb some Medicare fraud

23 February, 2016

category: Government, Health, Smart Cards

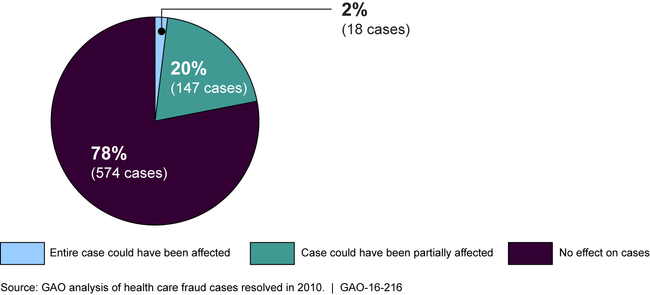

The use of smart cards for patient identification would curb about 22% of Medicare fraud cases, according to a report from the GAO. The GAO reviewed 739 health care fraud cases that were resolved in 2010 to try and find out how these schemes were conducted and if smart cards would prevent the fraud.

GAO’s analysis found that the use of smart cards could have affected about 22% (165 cases) of cases in which the entire or part of the case could have been affected because they included schemes that involved the lack of verification of the beneficiary or provider at the point of care.

The report found that the majority of fraud cases involved more than one scheme – 68% — and 61% included two to four schemes. Often the provider and patient were complicit in schemes as well.

The report found that the majority of fraud cases involved more than one scheme – 68% — and 61% included two to four schemes. Often the provider and patient were complicit in schemes as well.

In order to prevent Medicare fraud there isn’t one silver bullet. “There isn’t any one single answer that would stop fraud in health care, have to be multi-pronged approach,” says Kathleen King, direct of the health care team at the GAO.

However, in the majority of cases — 78% — smart card use likely would not have affected the cases because either beneficiaries or providers were complicit in the schemes, or for other reasons. For example, the use of cards would not have affected cases in which the provider misrepresented the service — as in billing for services not medically necessary — or when the beneficiary and provider were not directly involved in the scheme — as in illegal marketing of prescription drugs.

The Secure ID coalition has been pushing for a smart card to replace the paper card used by Medicare recipients and still says it can help stop the bleeding. A 2015 GAO report found that of the $125 billion in improper payments distributed across the government in 2014, nearly half — $60 billion — came from one federal program: Medicare. “If we follow the data, it becomes clear that something has to change in terms of how we authenticate Medicare transactions, protect beneficiary information and safeguard taxpayer dollars,” says Kelli Emerick, executive director at the Secure ID Coalition.

Also, since the GAO only looked at information from cases that were prosecuted in 2010 it may not be a representative sample. “Since most Medicare fraud occurs entirely under the government’s radar, the data reviewed represent only a fraction of the thousands upon thousands of cases of Medicare fraud that occur annually,” Emerick says. “Therefore, while the report is an important step forward in acknowledging the pervasiveness of fraud in the Medicare system, it almost certainly dramatically understates the impact of a smart card in reducing Medicare fraud.”

A Medicare smart card would stop fraud in a wide variety of cases. The GAO report list six different types of fraud schemes that would be prevented by smart card authentication at the point of care:

- Billing for services that were never actually provided

- Misusing a provider’s identification information to bill fraudulently

- Misusing a beneficiary’s identification information to bill fraudulently

- Billing more than once for the same service (known as duplicate billing) by altering a small portion of the claim

- Providing services to ineligible individuals

- Falsifying a substantial part of the records to indicate that beneficiaries or providers were present at the point of care

Bills submitted in the U.S. House of Representatives and U.S. Senate last year proposed a smart card pilot program for Medicare recipients. The status of the bill wasn’t immediately known.