SecureKey Verified.Me system managing 800 authentication transactions per second during pandemic

28 May, 2020

category: Corporate, Digital ID, Government

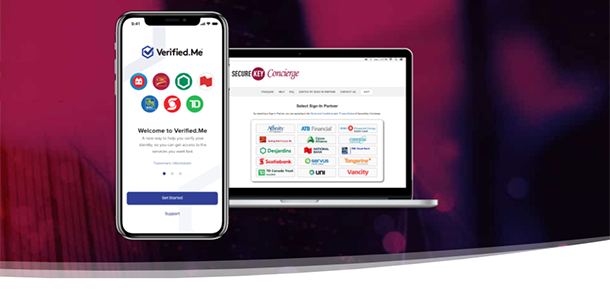

The SecureKey Verified.Me digital identity service began in 2019 via a partnership with leading Canadian banks. The authentication function, known as the SecureKey Concierge Service, has experienced a massive rise from 100 to 800 transactions per second as demand for remote authentication spikes.

The need for me to be able to prove who I am remotely without having to get really close, physical, is even more important now

The goal of the program is to secure consumer access to online services by using a blockchain to share a consumer’s info with Verified.Me identity providers and relying parties. Initial services focused on banking and government, but expansion is occurring in insurance, legal and healthcare services as well.

The coronavirus and resulting stay-at-home orders have led to a rise in the need to remotely identify and authenticate users, and this has led to the rapid increase in use of the Concierge Service.

“I think what happened with the COVID crisis is that people realized they have to get going with digital faster, and the need for me to be able to prove who I am remotely without having to get really close, physical, is even more important now,” says Greg Wolfond, chief executive officer of SecureKey, in an ITBusiness.ca article.

“This was a huge win for everyone because it worked, and kept going, but a huge effort on the team to make sure it’s up and running through this whole crisis. Kudos to the government for the work that they did, and our team for the part that they played,” Wolfond adds.