08 October, 2014

category: Biometrics, Digital ID, Financial, Government, Smart Cards

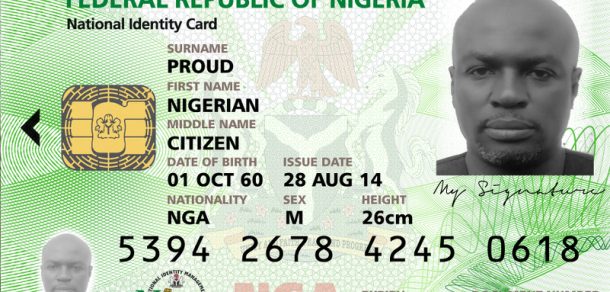

Nigeria – home to 160 million residents – is launching a national identity smart card that will include biometrics and an EMV payment application. At the end of August the first residents of Nigeria received their copy of the eID, a contact, polycarbonate smart card that replaced the current printed plastic identification document.

The National Identity Management Commission of Nigeria has rolled out an eID infrastructure, which includes registration authorities, identity management systems and secure card production facilities. Additionaly mobile devices for enrolling, reading and even updating some data stored on the card are part of the infrastructure, as well.

To receive the card, Nigerians aged 16 and above need to register at one of the hundreds of enrollment centers across the country. The enrollment process involves the recording of an individual’s demographic data and biometric data — capture of 10 fingerprints, facial picture and iris — to authenticate the cardholder and ensure that there are no duplicates on the system. Upon registration, the commission issues each Nigerian a unique National Identification Number, followed by the national eID card.

The Nigerian program is placing a focus on payments with the motto, “Bank the Unbanked” this feature provides first time access to electronic payment to millions of Nigerian citizens. Using the card as a payment tool, Nigerians can deposit funds, receive social benefits, save, or engage in many other financial transactions that are facilitated by electronic payments with biometric verification. Cardholders can also pay for goods and services and withdraw cash at millions of merchants and ATMS that accept MasterCard payment cards in Nigeria.

The eID is also being used as proof of identity and digital signatrues with biometrics. In the next phases the card will be extended to support additional electronic uses like driving license, health information card, tax record and voting functionality.

The various applications that run on the Nigerian eID card have been implemented with Java Card technology. A new card profile was developed for the Nigerian identity card in order to support different functionality. Within this framework it is possible to implement a range of applications on a single smart card.

The Nigerian eID project represent one of the the largest Public Key Infrastructures deployed worldwide. This PKI is comprised eight certification authorities and will issue more than 300 million certificates. This infrastructure is necessary to protect the eID system and the card iteself from hacker attacks.

Partners in the eID program include MasterCard as the payments technology provider, Unified Payment Services Limited as payments processor, and Cryptovision for Public Key Infrastructure and Trust Services Provider.