European consumers want biometric payments

14 July, 2016

category: Biometrics, Financial

New research from Visa shows that 73% of consumers across Europe are interested in using biometric payments – especially when integrated with other security measures. Nearly three-quarters see two-factor authentication, where a biometric is used in conjunction with a payment device, as a secure way to confirm an account holder.

When looking at the range of different payment situations at home or in the real world, 68% want to use biometrics as a method of payment authentication. Online retailers have the most opportunity for gain as 31% of people have abandoned a browser-based purchase because of the payment security process.

When looking at the benefits of biometric payments, 51% of Europeans state that biometric authentication for payments could create a faster and easier payment experience than traditional methods. Similarly, a third like the fact that biometric authentication means that their details would be safe even if their device was lost or stolen.

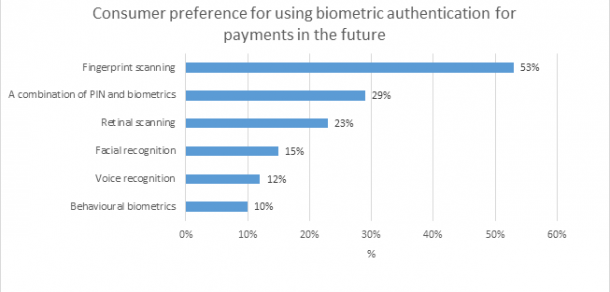

Europeans are also comfortable with a range of modalities. Fingerprint – being the most common – was perceived to be the most secure with 81% of those surveyed, followed by iris at 76%.

Across Europe, few people say they would prefer voice or facial recognition as a biometric payments method, 12% and 15%, respectively. In the UK, these figures fall to 8% and 12%, respectively, for voice or facial recognition as payment forms.

Consumers want to use biometrics for in-person transaction as well as online. This is reflected in the findings:

- 48% want to use biometric authentication for payments when on public transport

- 47% want to use biometric payments when paying at a bar or restaurant

- 46% want to use it to purchase goods and services on the high street e.g. groceries, coffee and at fast food outlets.

- 40% want to use it when shopping online

- 39% when downloading content

Ultimately, it won’t be just one biometric or security technology that is used for authentication, says Jonathan Vaux, executive director of Innovation Partnerships at Visa Europe. “One of the challenges for biometrics is a scenario in which it is the only form of authentication. It could result in a false positive or false negative because, unlike a PIN, which is entered either correctly or incorrectly, biometrics are not a binary measurement but are based on the probability of a match,” Vaux explains. “Biometrics work best when linked to other factors, such as the device, geo-location technologies or with an additional authentication method. That’s why we believe that it’s important to take a holistic approach that considers a wide range of enabling technologies that contribute to a better end-to-end experience, from provisioning a card to making a purchase to checking your balance.”

Visa commissioned the biometric payments research with Populus. The research was conducted between April and May 2016 in seven European countries: UK, Sweden, Spain, France, Germany, Italy and Poland. The total sample size was 14,236 with around 2,000 respondents per country.